Mobile wallets have become a rage now, being convenient and easy to use. Gone are the days of carrying thick bundles of cash. Cards are must haves at present, mobile wallets being the second most favourites. It may take more time before Indians completely embraces the mobile wallets. Airtel has been the leading service provider for the mobile users all over India for more than 20 years now. Their Airtel Money app was launched back in the January of 2011. For all those who has been using this app and for those who haven’t yet started using it, here’s all the details so that you can use the Airtel Money app the right way.

What you need to know

Here’s all of what you need to know about the Airtel Money app:

- What is the Airtel Money app?

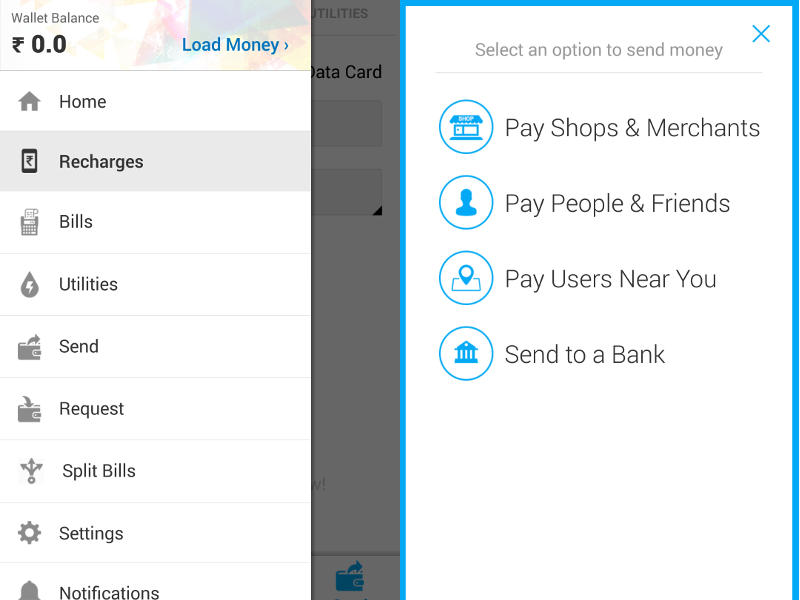

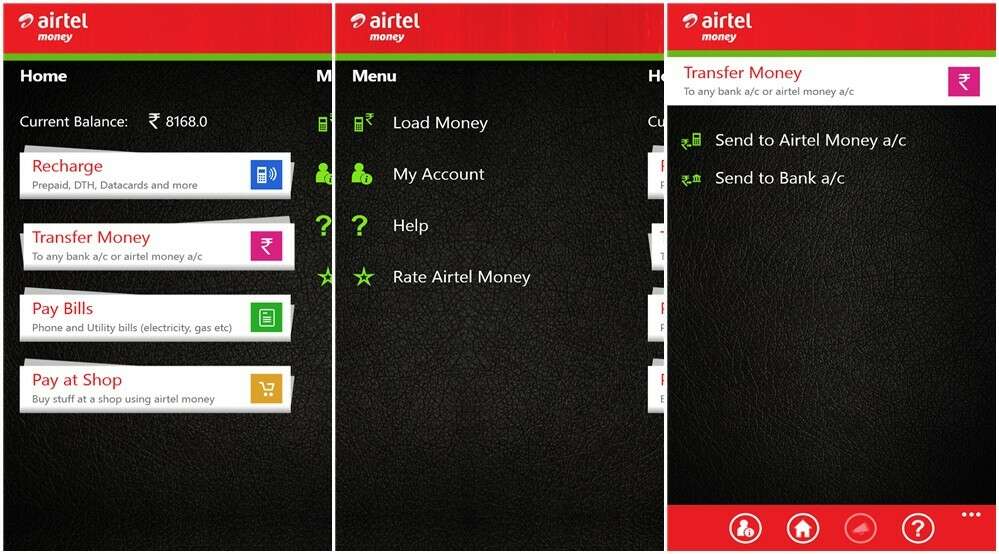

The Airtel Money app is nothing but a digital wallet that can be used to buy recharges and make bill payments online. Besides this, you can transfer money from your wallet to another in a matter of few seconds. And if you are wondering if the money can be transferred to bank accounts, then let me add that it can definitely be done.

- How to create your Airtel Money account?

To create your Airtel Money account, you need to download the app on your mobile and register. And to start using, simply load up cash into the account just as you slip money into a physical wallet. Whats more? It can be downloaded and used on any Smartphone. - Where can you use this e-wallet?

Using the Airtel Money wallet you can do mobile and DTH recharges, pay the utility bills, do online shopping, book movie tickets and other services such as spas and transfer and receive money smoothly from one account to the other, be it your friends’ Airtel wallet or a bank account. And the best part about this wallet with respect to shopping is that you can use it at offline stores as well.

- What are the account types?

There are two types of accounts available under Airtel Money wallet. These are Power and Express. The only difference between these two is the balance and usage limits. While the balance limit for Power is INR 1,00,000 and the usage limit is upto INR 50,000 per day, the balance limit for Express is INR 10,000 and the usage limit is upto INR 10,000 per month. There is no difference in the services. - Can money be withdrawn from the accounts?

This is a digital wallet and money once loaded onto the account cannot be withdrawn directly from it, unlike the bank accounts. If you need to withdraw money, the only way to do that is to transfer the money to your bank account and then withdraw it.

- Why should you be using the Airtel Money wallet?

The Airtel Money app makes life easier. How? You get to download it for free. You can use to make several payments and money transfer, just as your wallet without the hassle of maintaining physical cash. It is extremely safe to use, where the payment has to be confirmed with a PIN. Therefore, the chances of losing money even if you lose your phone is zero. Additionally, you can grab exclusive offers against Airtel Payments on Airtel Money app. - Can you have more than one account?

You can have only one account in your name with Airtel Money. But, you need be at least 18 years of age and an Indian resident in order to have an account on Airtel Money app.

Did we miss any points? If yes or if there is anything else you would like to know, do ask in the comments section.

Image Courtesy:

Digitalguru

NDTV Gadgets

Brothersoft

Windows Central